OPM ATS FAQ

Accessing OPM ATS

Who can access OPM ATS?

Only authorized Subscribers may access and trade on the Trading Platform. Anyone who meets the acceptable investor criteria as noted below can apply to be a Subscriber on the OPM ATS. In order to become a Subscriber, the following criteria must be met:

- be a qualified investor 1;

- provide certain information to OPM, including information required in accordance with KYC and AML onboarding procedures; and

- meet all Subscriber requirements per the Subscriber agreement.

How does a Subscriber access OPM ATS?

Subscribers access the Trading Platform from the OPM ATS website. The trade screen is restricted to authorized Subscribers who have completed onboarding. Once the Subscriber clicks on the Login button, the Trading Platform login screen appears prompting the Subscriber to enter a unique Username and Password.

Will Subscribers require special training to use the OPM ATS website?

Any Subscriber familiar with web-based applications can intuitively navigate through the different OPM ATS menus via the OPM ATS. OPM ATS screens are designed to be responsive, (i.e. adjust based on the screen size of the Subscriber computers).

Can Subscribers share usernames and passwords?

Each Subscriber will have a private, exclusive and non-transferable username and password for accessing the OPM ATS. Each Subscriber is responsible for safeguarding the confidentiality of the relevant Username and Password data and preventing unauthorized access to the OPM ATS.

User Security

What if a Subscriber username and/or password is lost or stolen?

Any orders entered, trades executed, or actions taken using the Username and Password of a Subscriber are the responsibility of said Subscriber. In the event of any security breach, or the loss of a Username and Password, Subscribers are obliged to report the matter to the Compliance Department of OPM immediately.

Does the OPM ATS have any login security protections?

OPM ATS is designed to prevent brute force attacks by limiting the number of times a user can enter incorrect Username/Password combinations. If a user exceeds the number of times they try to enter incorrect credentials, their account is locked and they are required to re-authenticate themselves and re-set their password. Reauthentication procedures may involve verification by OPM Compliance staff.

Does the OPM ATS have post-login security measures?

Subscribers are required to confirm every posted order by confirming the transaction on the trading screen.

User Interface

What user information is displayed after sign-in?

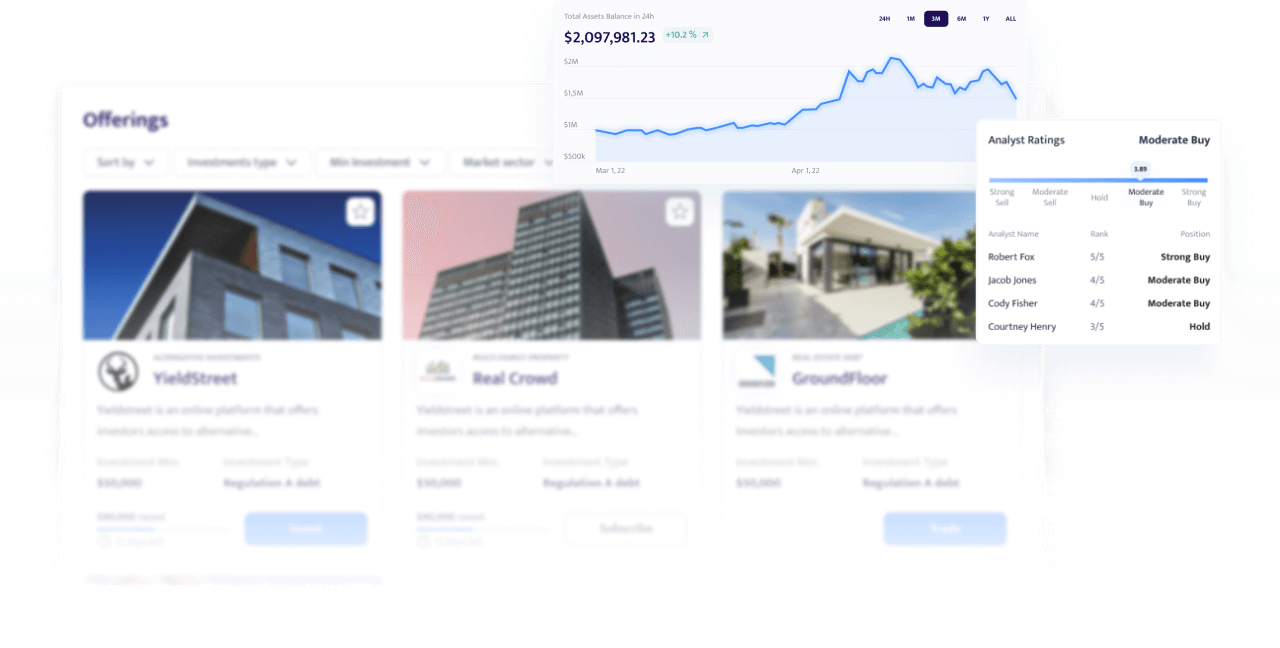

Once logged into the OPM ATS, Subscriber is taken to the trade screen. From there they can follow a link to view their history of Digital Securities orders and matches on the OPM ATS, or follow a link to see any primary offerings that are being made available for Subscribers to express their interest in.

What other information is displayed on the user account screen?

From the trade screen, Subscribers are able to view their open orders. At any time before a Digital Securities transaction is matched, Subscribers are able to cancel their order.

Trading

How can a Subscriber buy or sell a company’s Digital Securities on OPM ATS?

OPM offers Subscribers the ability to buy and sell a company’s Digital Securities on the secondary market using OPM ATS.

Are there any trading restrictions on when certain Digital Securities may be traded on the OPM ATS?

Privately placed Digital Securities issued on the OPM ATS are restricted from secondary trading for the period of one year from the time of issuance. Only privately placed Digital Securities held for longer than one year from the date of the initial issuance are available for trading.

How does a Subscriber buy Digital Securities on the OPM ATS?

If a Subscriber is interested in buying Digital Securities issued by a company, they can (1) browse the Offerings page to see if that company is currently conducting an offering; (2) access the OPM ATS to see if any existing holders are “offering” their securities; and (3) post a “bid” on the OPM ATS to indicate your interest in purchasing securities.

● Taking an offer: The OPM ATS will display all current sell orders, along with the amount of securities offered at that price. If a Subscriber would like to purchase the offered securities at the indicated offer price, the Subscriber can simply click on the item and complete the order entry screen.

● Posting a bid: If a Subscriber would like to alert sellers that they are interested in buying securities, they may post a “bid” indicating the securities, the price they are willing to pay, and the amount of securities they are willing to purchase. A Subscriber bid will constitute a live order on the OPM ATS, which means that if a seller accepts your bid, they will enter into a binding agreement to purchase the securities on their stated terms.

What information will a Buyer Subscriber be able to review prior to an order?

Buyer Subscriber wishing to purchase Digital Securities offered for sale view the offer and can click on “Buy” button. When clicking on the “Buy” button, they are presented with the purchase confirmation screen that displays the following information:

- Name of the digital security being purchased

- Purchase Price

- Total number of Digital Securities purchased

- Gross order amount.

How does a Subscriber sell securities on the OPM ATS?

If a Subscriber is interested in selling private company Digital Securities that they already own, a Subscriber can (1) access the OPM ATS to see if any purchasers have posted “bids” for those Digital Securities; and (2) post an “offer” on the OPM ATS to sell the Digital Securities.

- Hitting a bid: The OPM ATS will display all buy orders, along with the amount of securities the purchaser is willing to purchase at that price. If a Subscriber would like to sell securities at the indicated bid price, they simply click on the item and complete the order entry screen.

- Posting an offer: If a Subscriber would like to offer their securities for sale on the OPM ATS, they may post an “offer” indicating the securities, the price at which they are willing to sell, and the amount of securities the Subscriber is willing to sell at that price. Their offer will constitute a live order on the OPM ATS, which means that if a purchaser accepts the Subscriber’s offer, they will enter into a binding agreement to sell the securities on their stated terms.

What information must a Subscriber input to submit a sell order?

The investor is required to fill out the following fields:

- Number of Digital Securities; and

- All orders are required to be entered as limit orders. Sellers must provide a price per share The display at the bottom of the sale order will display the following two buttons: Post and Cancel.

Does a Subscriber need to buy or sell all of the relevant Digital Securities displayed on the OPM ATS?

No – whether you are buying or selling, a Subscriber has the ability to specify in their buy/sell order the total quantity of Digital Securities in they are interested in buying or selling.

What if there are not enough Digital Securities available to satisfy the amount of a Subscriber’s buy or sell order on the OPM ATS?

A Subscriber’s ability to buy or sell Digital Securities on the OPM ATS will depend on the availability of bids and offers from other OPM ATS users.

How long are bids or offers good for?

Any bids or offers posted on the OPM ATS will generally be good until canceled.

Can I sell securities on the OPM ATS that I did not purchase through OPM?

The OPM ATS permits Subscribers to sell securities that were initially purchased on the OPM ATS, whether in an initial offering or via the OPM ATS. In addition, the OPM ATS permits Subscribers to sell certain Digital Securities that were not purchased on the OPM ATS on a security case by case basis as determined by the OPM ATS and its principals.

May a Subscriber immediately use the proceeds of a Digital Securities sale or trade purchased Digital Securities?

Digital Securities are not effectively transferred to the Seller until settlement between Buyer and Seller and successful payment for the purchase is made. Any subsequent transfer or sale of purchased Digital Securities will depend on regulatory restrictions and whether the relevant Transfer Agent at their own sole discretion whitelists the new owner to transfer the Digital Securities.

Order Display and Entry

Does the OPM ATS support pre-arranged trading?

No. Subscribers are not allowed to identify or contact other Subscribers with an offer to purchase or sell a particular security and then subsequently enter that prearrangement into the ATS as an order.

How are orders displayed on OPM ATS?

All buy and sale orders are displayed on the trade screen of the OPM ATS.

Note that since transactions happen directly between Subscribers, multiple orders in the same security are not aggregated even if they are posted at the same price, i.e. each sale order is displayed as a separate item.

For each sale order the following information is displayed:

- Name of the security offered for sale

- Limit Price

- Total number of Digital Securities offered for Sale

- Gross order amount.

Subscriber wishing to purchase Digital Securities offered for sale can click on individual sale orders and view additional details if applicable.

What if I make a mistake entering an order?

A Subscriber will always have the chance, and the obligation, to confirm the terms of all orders before those orders are submitted to the OPM ATS, and a Subscriber is responsible for any trades that result from their orders.

Can a Subscriber cancel or modify an order?

A Subscriber may cancel a bid or offer at any time until it is executed. Once the terms of an offer or bid are agreed to by the counterparty, a Subscriber’s order is binding and cannot be modified or cancelled.

Fees

Does the OPM ATS charge a fee?

The OPM ATS charges a 2% transaction fee on all purchases and sales. These fees will not be applied until the trade is settled off the ATS. For buyersand sellers, the fees will be communicated through a separate invoice sent after the orders are matched.

Does OPM charge Subscriber Fees?

The OPM ATS does not currently charge a Subscriber fee outside of the 2% transaction fee on all purchases and sales.

Does OPM ATS provide special fee arrangement, e.g. by volume of trades?

The OPM ATS does not currently provide special fee arrangements.

1 Any transactions OPM facilitates would be limited to accredited investors, qualified purchasers (“QPs”), qualified institutional buyers (“QIBs”) and institutional investors.