Over the past few years, blockchain technology has become one of the fastest growing spaces in FinTech. As a result, many companies have begun to look to decentralized protocols to address a variety of use cases. The applicable use cases are many and vary widely, ranging from payment protocols, supply chain, national security, to even fine art and real estate. While we are still in the early years of adoption of this technology, one industry that has become a target for disruption is the capital market sector. One potential area for disruption will be enabled by digital securities. Digital securities are set to play a major role in transforming centralized traditional financial systems to decentralized, trustless blockchain based settlement engines.

What is a Digital Security?

Digital securities, similar to traditional securities, represent a proof of ownership in an underlying asset or company. Unlike traditional securities, digital securities are issued directly on a blockchain and can be programmed to comply with regulatory requirements and standards which allow them to be purchased and traded.

As an example, digital securities offered by Oasis Pro Markets enable issuers to raise capital and permits investors to purchase these primary offerings and then trade them with ease on the secondary market via our Alternative Trading System (ATS).

Benefits of Digital Securities

Settlement:

Traditional exchanges operate on a T+2 (Trade date + 2 business days) settlement time, which means securities typically settle into an investor's account 2 business days after a trade has been executed. Digital securities through the use of blockchain technology inherit the advantage of being able to achieve near T+0 settlement times. The near instantaneous settlement times is enabled by the underlying blockchain and the smart contract which governs the security.

Efficient Payment Distributions:

Digital securities may offer dividends or coupon payments to their holders. In a traditional market, dispersing these payments to holders can take multiple days, if not weeks, to determine eligible participants. Meanwhile, the time value of money declines during that waiting period, and investors become subject to opportunity and reinvestment risk. Digital securities on the other hand can achieve efficient distributions of payments and leverage near-instant settlement times, offering investors improved liquidity in terms of portfolio access.

Liquidity and Fractional Ownership:

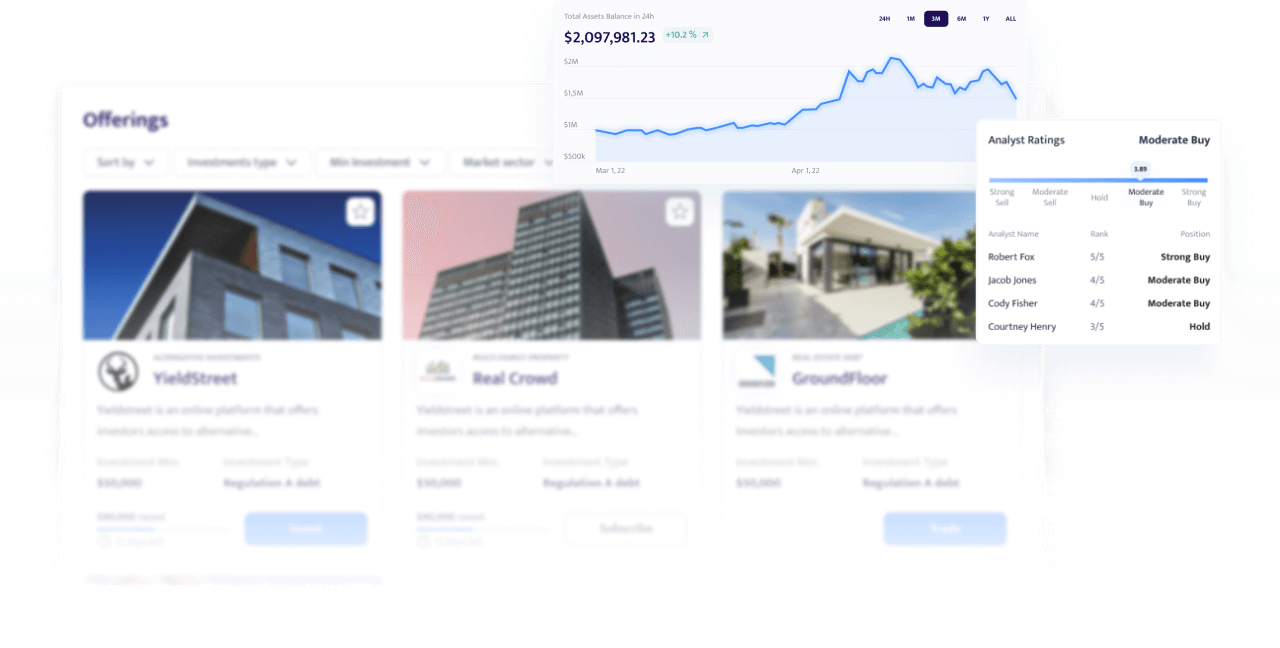

Private markets often face liquidity issues for multiple reasons including the number of eligible investors, offerings sizes, or the barriers of entry required to trade. Blockchain enables borderless liquidity opportunities and the ability to fractionalize digital securities, yielding more diversification opportunities for investors. Recently, we have seen unprecedented growth in the DeFi markets, and since Oasis Pro Market's ATS enables investors to purchase and trade digital securities with digital cash (e.g. stablecoin), we have extended the purchasing opportunity to a new group of investors holding digital currency. With the Oasis Pro Markets’s ATS, investors will be able to purchase and trade securities in a compliant way using digital cash, which has the potential to inject a new source of global liquidity into digital security markets.

Compliant:

The programmability of digital securities exists within its smart contract creation. Digital securities are programmable and therefore can only execute the procedures that were built into their smart contracts. Smart contracts, once deployed onto a blockchain, are immutable and their functions govern how a digital security can be bought and traded. Smart contracts give us the ability to carefully program compliance directly into the code and, through whitelisting, always ensure that KYC/AML approved individuals can hold and trade their digital security.

Diversification:

Investors often strive for diversification in their portfolios. By owning different types of equity or fixed income products in one's portfolio, investors have been able to balance their returns and risks. Since digital securities are programmable, they can be issued to prove ownership in virtually any asset, giving investors more opportunities for diversification. Have an interest in fine art? Well, through digital securities you can own a portion of that Monet you have always admired! Or maybe you have always wanted to own an apartment building in Tokyo…The possibilities and opportunities for diversification are endless.

Cap Table Management:

Digital securities inherit transparency and auditability from the underlying blockchain on which they operate. For issuers, this is an advantageous feature that enables them to view the realtime ownership information, and manage other interactions with investors, such as payment distributions or voting rights.

Want to learn more about Oasis Pro Market or engage our advisory on digital security issuance? Reach out to us at info@oasispromarkets.com

OasisProMarkets.com and all details, content materials, products and services (including blog posts) on or otherwise made available to you through this website are provided by Oasis Pro Markets LLC on an “as is'' and “as available” basis, unless otherwise specified in writing. Oasis Pro Markets LLC makes no representations or warranties of any kind, express or implied, about the operation of this website or the information, materials, products (including software) or services listed on or otherwise made available to you through this site, unless otherwise pointed out in writing. You expressly agree that your use of this website is at your own risk. None of the blog posts published on OasisProMarkets.com should be construed as investment advice. We strongly advise our readers to always do their due diligence before making any investment decisions.