OP supported Apollo in Project Guardian, deploying Fund token contracts on Provenance Blockchain and leveraging the capabilities of Axelar Network’s interoperability solution.

Oasis Pro (OP) utilizes blockchain technology to offer comprehensive market solutions that bridge traditional finance from Web2 to Web3, increasing efficiency, transparency, and accessibility of financial markets. The OP team’s well-rounded experience, in collaboration with other industry leaders, supports enhanced accessibility and trading of digital assets across various networks and liquidity pools as demonstrated in Project Guardian.

Project Guardian, hosted by the Monetary Authority of Singapore (MAS), aims to leverage the benefits of asset tokenization and DeFi in regulated financial markets. Apollo and Onyx by J.P Morgan (Onyx) led an initiative under Project Guardian which seeks to showcase how tokenization can enhance the operational fluidity of alternative and traditional assets and integrate them seamlessly into automatically rebalanced model portfolios, including discretionary SMAs for private banks and wirehouses. Multiple traditional finance and blockchain industry collaborators participated in the initiative including Oasis Pro, Axelar, Provenance, Wisdom Tree, Ava Labs, LayerZero, and Biconomy.

Complementing the depth and breadth of the Provenance Blockchain, OP deployed Fund Token smart contracts and Axelar Gateway contract that engage with the Provenance Marker contract. This enabled portfolio managers to initiate portfolio rebalancing from ODA by invoking smart contracts deployed by OP on Provenance Blockchain for the mint and burn functions. For the Fund Tokens, Oasis Pro implemented the ERC-20 token standard in ProvWasm using Provenance Blockchain Markers and extended the standard to include the Mintable and Burnable interfaces from the Onyx by J.P. Morgan Digital Asset Fungible Token Contract (ODA-FACT) token standard.

In addition, the OP team collaborated with Axelar Network and Provenance Blockchain to establish security guardrails and robust exception-handling mechanisms. These measures ensure a detailed response is provided in unexpected circumstances where a transaction fails. For instance, if the ODA chain initiates a burn exceeding the token balance amount, OP will provide the ODA chain with comprehensive details explaining why the transaction was unsuccessful.

The broad expertise and diverse solutions offered from the companies involved in this POC provided the foundation supporting this landmark initiative. The collaborative efforts of Apollo, Onyx by J.P. Morgan, Provenance Blockchain, Axelar Network, and Oasis Pro set the stage to cultivate a more efficient and frictionless rebalancing process for portfolio managers.

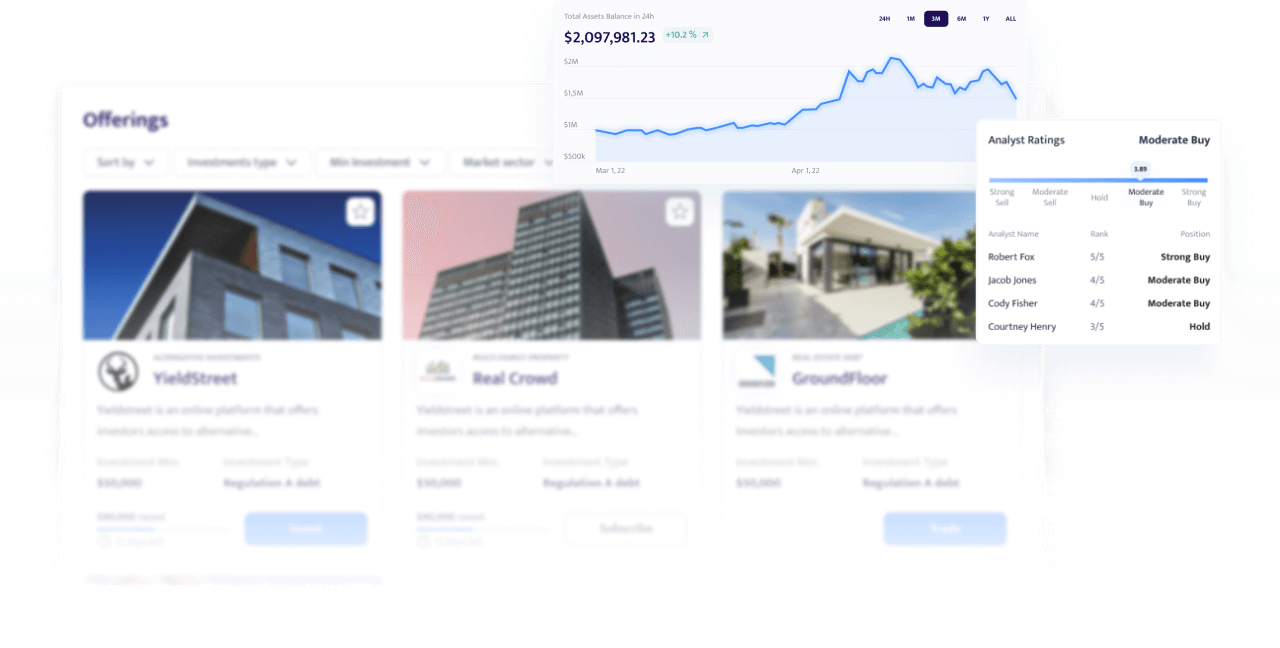

As a first mover and industry thought leader, Oasis Pro’s contribution to this POC results in furthering our mission of evolving capital markets. Through our end-to-end offerings of Tokenization, Transfer Agent, and Alternative Trading System (ATS) services, Oasis Pro offers a comprehensive solution to fulfill the tokenization requirements of fund managers. Within our ecosystem, fund managers can seamlessly create marketplace offerings, tokenize these offerings on their preferred blockchain, manage the cap table, and facilitate secondary trading of these tokens.