The rise of algorithmic trading technology took nearly 20 years to become mainstream in the financial landscape with the SEC finally authorizing electronic exchanges in 1998. This technological revolution transformed trading from human to program based increasing liquidity and decreasing settlement times and risk. Akin to that evolution, the capabilities and benefits of blockchain technology will catapult the global finance industry to the next level of efficiency and opportunity.

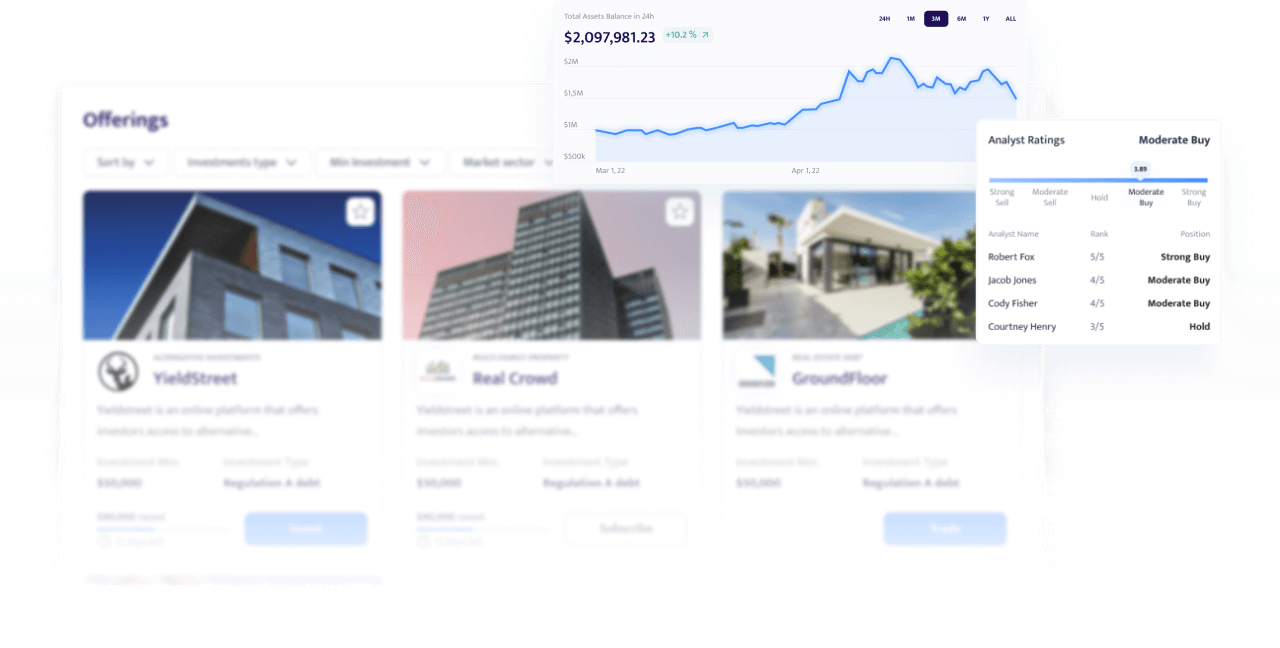

Imagine a scenario as an investment manager where you build a diversified investment basket utilizing a blend of both traditional financial instruments and Web3 based yield instruments that achieves more attractive yields with potentially less risk. This scenario along with increased liquidity and metrics such as benchmark rates can be achieved today for institutional as well as retail investors. The financial landscape is undergoing a seismic shift as we are introduced to the next generation of financial technology with the evolution of decentralized finance (DeFi) and the broader Web3 ecosystem.

From staking and liquidity provision to yield farming, the Web3 ecosystem provides a myriad of opportunities for investors to earn returns, often surpassing those seen in traditional markets. Investment managers can leverage the burgeoning world of Web3 yield to introduce new opportunities and enhance portfolio diversification and in this early-stage environment get a step ahead of the rest of the market.

A New Era of Diversification for Investment Managers

The quest for more attractive levels of risk-based yield has long been a focus of investors, yet the foundational concept of yield has remained unchanged for centuries, making it ripe for evolution. Now with the advent of DeFi and blockchain technology the meaning of yield and how it’s generated has been redefined as decentralized, transparent, and potentially more lucrative than traditional yield sources.

Financial markets have long been influenced by macroeconomic factors, geopolitical tensions, and central bank policies. Web3 yields, on the other hand, are driven by factors unique to the decentralized ecosystem, such as network activity, technological advancements, and community engagement. This inherent difference provides a unique diversification opportunity, allowing investors to hedge against traditional market downturns and volatility.

For investment managers, the new frontier of Web3 yield presents a golden opportunity, but also challenges. Traditional portfolios, often dominated by stocks, bonds, and commodities, can now be diversified with digital assets that typically offer more attractive yields. By integrating Web3 yield sources into investment strategies, managers can not only create the opportunity for enhanced returns but also tap into a market that's less correlated with traditional assets, providing a hedge against market volatility. However, navigating this new landscape requires a deep understanding of blockchain technology and its associated risks.

Capitalizing on the Opportunity

The world witnessed a paradigm shift in how financial rewards could be earned following Ethereum's transition to Ethereum 2.0 and its Proof-of-Stake (PoS) consensus mechanism (the “Merge”) in September 2022. Building off of the Merge and enhancing upon these advancements ETH holders now can stake their tokens (“stakers”) to support network operations. In return for this, stakers are rewarded yield, creating a new and attractive avenue for return utilizing blockchain DeFi offerings. This yield is more than a passive income stream - it's a testament to the evolving dynamics of blockchain-based finance and its ability to elevate traditional financial instruments.

A prime example of the potential of Web3 yield is the recent announcement of the Composite Ethereum Staking Rate (CESR) index. The index provides a transparent and standardized measure of potential returns from Ethereum staking. For investment managers, this index serves as a tangible metric to gauge the profitability of staking in the Ethereum ecosystem, offering insights into the evolving dynamics of the Web3 yield landscape.

The Significance of Digital Transformation

The world of finance is on the cusp of a new era, with Web3 yield and Ethereum staking rewards leading the charge. The rise of Web3 yield signifies a move towards a more inclusive, decentralized, and transparent financial ecosystem. For investors and financial professionals, it's a call to adapt, learn, and evolve and presents a unique opportunity to diversify portfolios, enhance returns, and position themselves at the cutting edge of financial innovation.

As the lines between traditional and decentralized finance continue to blur, those who take tangible steps and embrace the potential of Web3 yield and understand its diversification benefits will undoubtedly have the opportunity to be a leader of this emerging financial revolution.

Disclaimer: Information provided is for informational purposes only and should not be considered as financial, investment, or legal advice. You should conduct your own research and consult with professionals before making any decisions. Risks associated with tokenization include the potential for loss of investment, market volatility, regulatory uncertainty, and technological risks.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Oasis Pro. Oasis Pro does not assume any duty to update any of the information.